Why Most Chemical Suppliers Fail Google Search (and How to Fix It)

6 mins | 10 Sept 2025

Introduction: The Invisible Supplier Problem

I still remember a conversation with the owner of a mid-sized chemical company in Gujarat. He exports stabilizers to Europe and the Middle East. His business is strong offline — loyal distributors, long-term contracts — but when I searched “lead-free PVC stabilizers supplier India”, his company was nowhere to be found.

He looked at me and said:

“But Mehek, our website is live, datasheets are there. Why don’t we show up?”

This is not an isolated story. Over the last two years, I’ve spoken with dozens of chemical suppliers — from aroma chemical exporters in Maharashtra to agrochemical manufacturers in Hyderabad. Almost all of them fail at Google Search.

Why? Because their websites are built like catalogs, not like growth engines.

This article will unpack the 5 big reasons chemical suppliers fail at Google Search — and more importantly, how to fix each one with actionable steps.

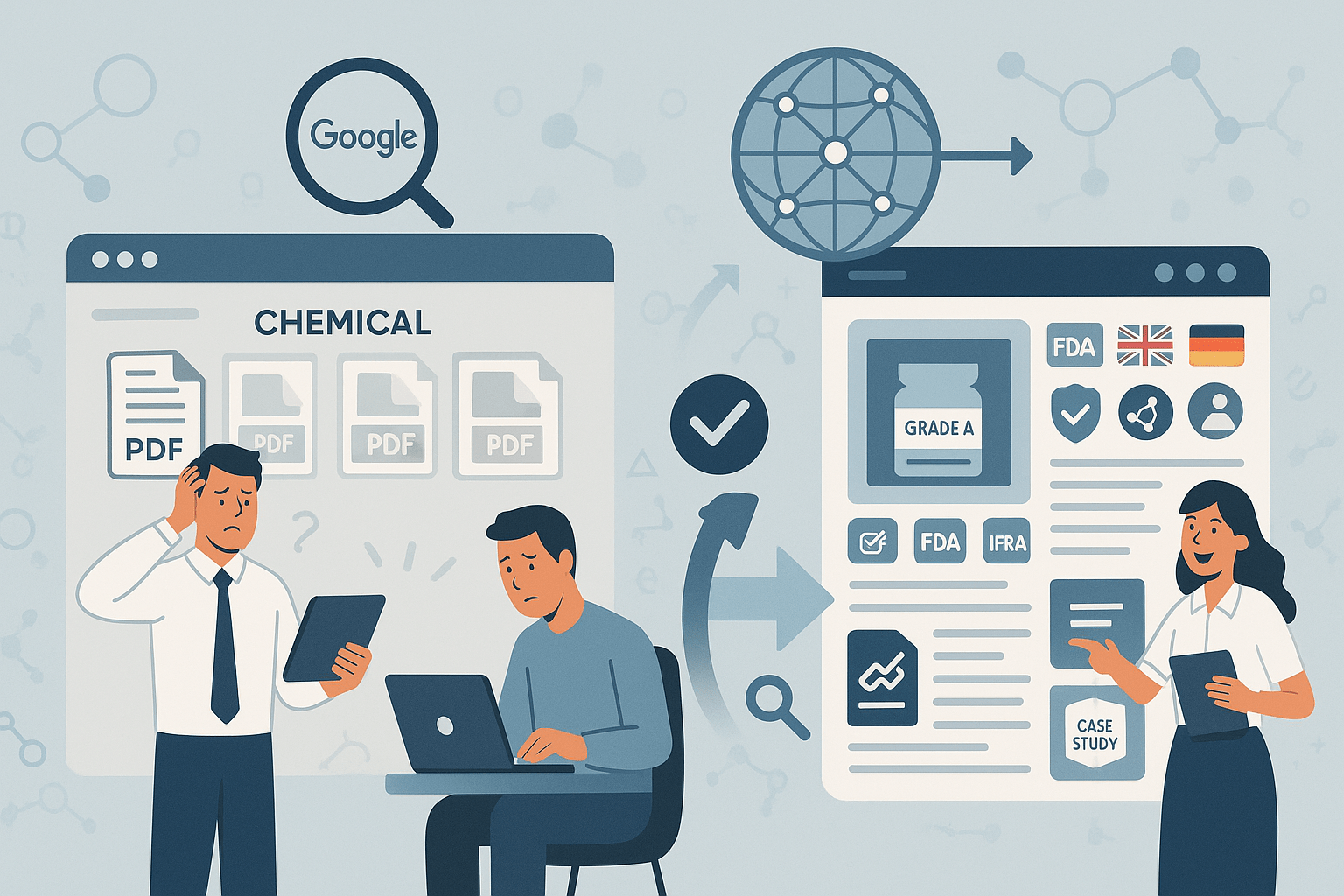

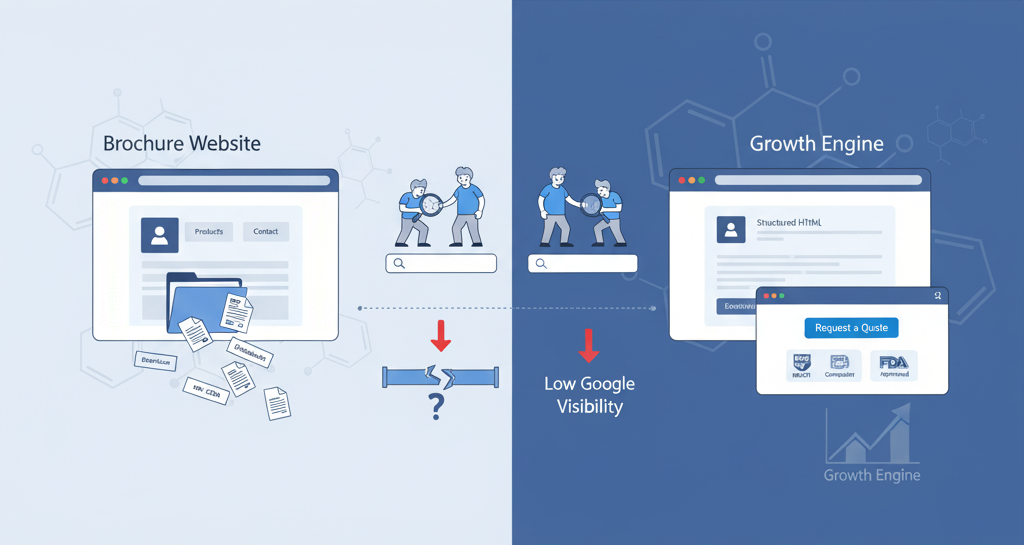

Reason 1: Treating the Website as a Brochure, Not a Growth Engine

Most chemical supplier websites look like this:

- A homepage with “About Us” and product categories.

- A few PDFs of datasheets, SDS, and COAs.

- A generic “Contact Us” form.

That’s it.

The problem? Google doesn’t rank static brochures. It ranks websites with structured, optimized, and engaging content.

How to Fix It

- Create dedicated product pages (one per grade) with:

- Title tags & meta descriptions targeting buyer searches.

- Key specs summarized in HTML, not just in PDFs.

- Compliance badges (REACH, FDA, IFRA).

- Clear CTAs: “Request a Sample”, “Talk to an Expert”.

- Add case studies & application pages: e.g., “Stabilizers for Medical PVC Applications”.

- Treat your site as a growth engine, not just a catalog.

👉 Example: After we restructured Advent ChemBio’s site into product-grade pages, Google impressions tripled within 3 months.

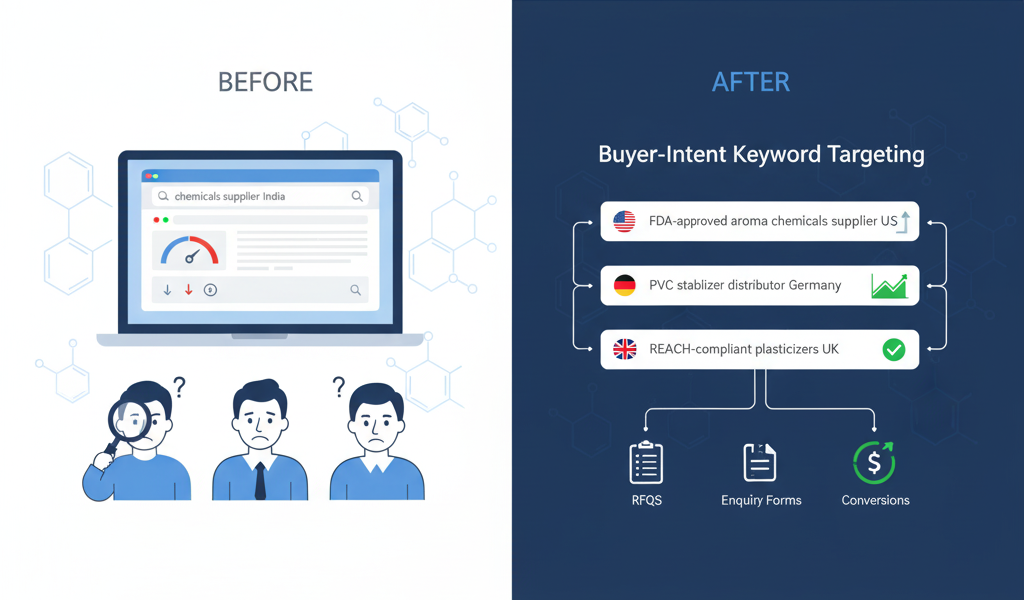

Reason 2: Ignoring Buyer-Intent Keywords

Most suppliers optimize for vanity terms like “chemicals supplier India”. But real buyers search differently.

Buyer Search Examples

- Procurement: “FDA-approved aroma chemicals supplier US”

- R&D scientist: “99.5% benzyl alcohol datasheet REACH compliant”

- Distributor: “PVC stabilizer distributor Germany”

If your site doesn’t align with these long-tail, high-intent searches, you won’t show up.

How to Fix It

- Build keyword clusters around buyer intent:

- Product + compliance + region

- Application-specific searches

- Create content hubs:

- Blog: “Top 10 Aroma Chemicals Suppliers in Europe”

- Guide: “How to Choose REACH-Compliant Stabilizers for Packaging”

- Case study: “How Privi Lifesciences Expanded Exports to Europe”

👉 Action Tip: Use SEMrush/Ahrefs, but also talk to your sales team — they know the exact questions buyers ask.

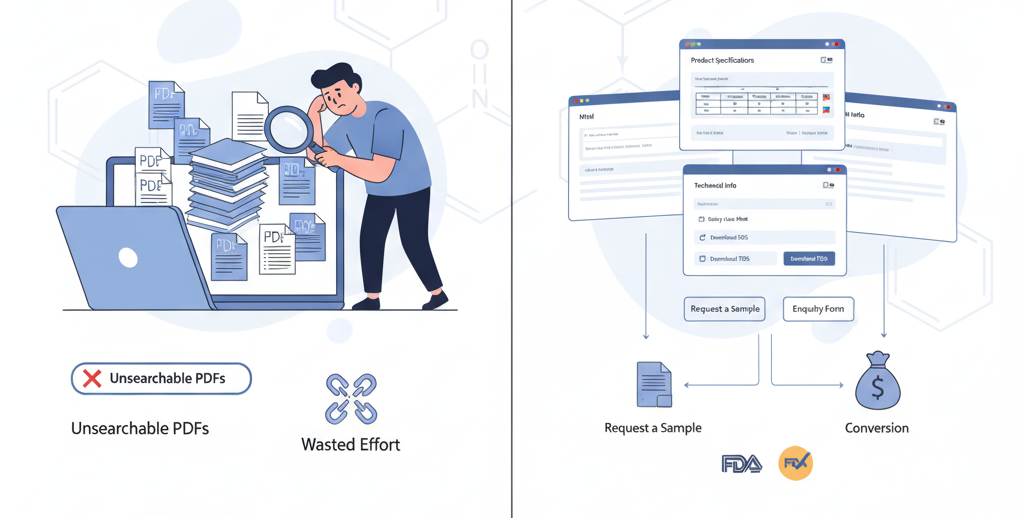

Reason 3: Hiding Everything Inside PDFs

Every chemical company has datasheets and SDS. The mistake? Dumping them online as PDFs.

Why This Fails

- Google can’t properly index PDFs.

- Buyers hate hunting through 40-page PDFs for one spec.

- You lose the chance to guide them further.

How to Fix It

- Create HTML pages for every datasheet with:

- Spec tables, compliance flags, updated dates.

- Link to the PDF for download, but keep page SEO-rich.

- Add soft gates: “Download latest SDS — we’ll email you updates when it changes.”

- Use schema markup for Product and TechnicalDocument.

👉 Impact: At Privi Lifesciences, HTML datasheet pages outranked competitor PDFs in 60 days.

Reason 4: Forgetting International SEO

Most suppliers serve global buyers, but their websites scream “local.”

Common Issues

- Only in English (no German, Spanish, French).

- Hosted on .in domain, no US/UK/DE versions.

- No hreflang tags — so Google shows the wrong version to the wrong region.

How to Fix It

- Add country folders: /us/, /uk/, /de/.

- Implement hreflang tags to guide Google.

- Translate & localize key pages for Germany (REACH konform, Aroma Chemikalien).

- Highlight compliance relevant to region: FDA (US), REACH (EU), IFRA (fragrance).

👉 Example: Advanta Seeds’ multilingual SEO led to higher visibility in LATAM and Europe, opening new RFQ pipelines.

Reason 5: Weak Authority Signals

Google ranks trustworthy sites higher. In chemicals, most suppliers fail here.

Why?

- No backlinks from industry portals.

- No thought-leadership content (blogs, guides, webinars).

- No visible proof of credibility (case studies, testimonials, certifications).

How to Fix It

- Secure backlinks from industry directories and magazines (ICIS, ChemEurope, Chemical Weekly).

- Publish whitepapers and guides: e.g., “Future of REACH Compliance in 2025”.

- Add trust banners: ISO certifications, REACH badges, audit-ready proof.

- Showcase case studies with numbers: “Reduced sourcing time by 30%.”

👉 Buyers — and Google — reward trust and authority.

Action Plan: 60-Day Fix for Chemical Suppliers

Day 1–15: Foundation

- Audit your site: Are products discoverable? Are datasheets HTML?

- Map 50 buyer-intent keywords (per region: US, UK, DE).

Day 16–30: Content & Structure

- Build 10 optimized product-grade pages.

- Create 3 compliance-focused landing pages (REACH, FDA, IFRA).

- Write 2 listicle blogs (e.g., Top Suppliers in Your Segment).

Day 31–45: Technical SEO

- Implement hreflang for US/UK/DE.

- Add schema (Product, FAQ, Article).

- Improve Core Web Vitals (speed, mobile).

Day 46–60: Authority & Outreach

- Publish 1 whitepaper for global buyers.

- Get listed in 5 chemical directories.

- Pitch 1 guest article to Chemical Weekly or ChemEurope.

👉 Within 60 days, you’ll start ranking for buyer-intent searches and see a steady flow of qualified enquiries.

Conclusion: From Invisible to Indispensable

Chemical suppliers don’t fail on Google because they lack good products. They fail because their websites are invisible, outdated, and brochure-like.

The fix is straightforward:

- Build structured product pages.

- Target real buyer keywords.

- Stop hiding behind PDFs.

- Go international with SEO.

- Build authority with proof and backlinks.

Do this, and your company will stop being a hidden supplier and start becoming a visible, trusted partner for global buyers.

The digital battlefield is already here. The question is: will your company remain invisible — or take its rightful place on Page 1?

Author

_desktop_list_webp_488ed91b.webp)